Searching For Excellent Home Mortgage Advice? Beginning Here!

Article created by-Rask HopperBeing a homeowner brings a great sense of pride. Almost everyone who buys a home must first get a mortgage loan. Going through all the steps to home ownership can be confusing and time-consuming. Keep on reading to learn how to get the right home mortgage.

To make sure that you get the best rate on your mortgage, examine your credit rating report carefully. Lenders will make you an offer based on your credit score, so if there are any problems on your credit report, make sure to resolve them before you shop for a mortgage.

Remember that the interest rate isn't the most important part of a mortgage. You also have to think about closing costs, points and other incidentals. There are different kinds of loan as well. That is why you have to find out as much as you can about what you're eligible for.

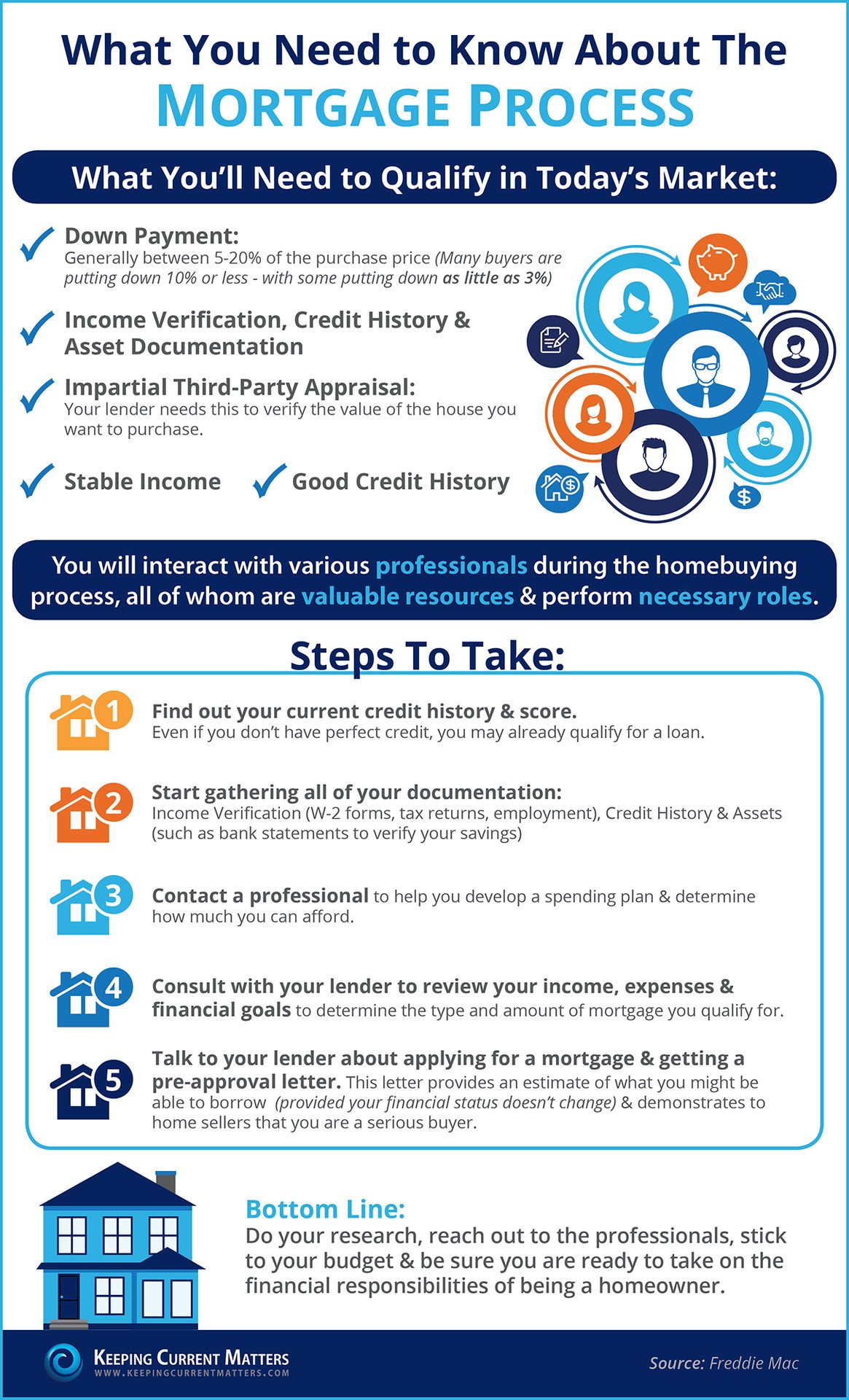

Have all your ducks in a row before walking into a lender's office. Showing up without the proper paperwork will not help anyone. Your lender will need to see this necessary information, and having it on hand will help speed up the process.

Try getting pre-approved for a mortgage before you start looking at houses. This will make the closing process a lot easier and you will have an advantage over other buyers who still have to go through the mortgage application process. Besides, being pre-approved will give you an idea of what kind of home you can afford.

Do not waste time in your home mortgage process. After you've submitted a mortgage application to the lender, this is when your clock start ticking. You have to send any necessary documents for the application process quickly. Any delays could destroy a purchase and cost you your deposit. Get an expected closing date, and then keep in touch with the lender periodically until your loan closes. Some lenders close quicker than others.

Make sure you look at multiple mortgage lenders before settling on one. You definitely need to do some comparison shopping. There are a lot of different mortgage rates and deals out there, so stopping at just one could really mean wasting thousands of dollars over the life of your mortgage.

Balloon mortgages are among the easier ones to get approved for. These loans offer a short term with the balance owed at the end of the loan. These loans are risky because you may not be able to obtain financing when the balance comes due.

Hire an attorney to help you understand your mortgage terms. Even those with degrees in accounting can find it difficult to fully understand the terms of a mortgage loan, and just trusting someone's word on what everything means can cause you problems down the line. Get an attorney to look it over and make everything clear.

Take the time to get your credit into the best shape possible before you look into getting a home mortgage. The better the shape of your credit rating, the lower your interest rate will be. This will mean paying thousands less over the term of your mortgage contract, which will be worth the wait.

You likely know you should compare at least three lenders in shopping around. Don't hide this fact from each lender when doing your shopping around. They know you're shopping around. Be https://www.forbes.com/advisor/taxes/how-to-contact-the-irs/ in other offers to sweeten the deals any individual lenders give you. Play them against each other to see who really wants your business.

Learn about the three main types of home mortgage options. The three choices are a balloon mortgage, a fixed-rate mortgage, and an adjustable-rate mortgage (ARM). Each of these types of mortgages has different terms and you want to know this information before you make a decision about what is right for you.

Make sure that you compare mortgage rates from several companies before you settle on one. Even if the difference seems to be minimal, this can add up over the years. One point higher can mean thousands of extra you will have to shell out over the course of the loan.

Before you contact a mortgage lender to apply for a loan to buy a home, use one of the fast and easy mortgage calculators available online. You can enter your loan amount, the interest rate and the length of the loan. The calculator will figure the monthly payment that you can expect.

If relevant webpage are a first time home owner, get the shortest term fixed mortgage possible. The rates are typically lower for 10 and 15 year mortgages, and you will build equity in your home sooner. If you need to sell you home and purchase a larger one, you will have more cash to work with.

Pick your price range prior to applying to a broker. If it should be that a lender gives you more money than you can pay back monthly, you'll have some extra room. Do not overextend yourself no matter what. If you do this there may be financial issues later.

One item of documentation for home mortgage application that is often overlooked is a gift letter. If your relatives have chipped in to help you make your down payment, you may need to document your source of income. This really depends on the type of home mortgage you get. Some require this, and others do not. Play it safe by getting a gift letter from anyone who gives you money to help you buy your home. Have this on file with your other documentation.

If your mortgage application is denied, do not give up. Banks follow their own lending standards and another bank may accept you. Keep in mind that lending standards are much stricter than they were a decade ago, though. When you are turned down, ask why. Then work on fixing that problem.

Hopefully, these tips have taken some of the mystery out of the mortgage process. Maybe now it is time you took the plunge. The tips that you read should help guide you through this process. Now find a lending company and put the advice to use.